Sale of the Balla Balla Project to Gold Valley

About Us

Sternship Advisers is a boutique Perth-based advisory firm established in mid-2017 by the former UBS Perth team.

Sternship prides itself on the provision of trustworthy corporate finance advice by highly experienced senior bankers who are free of conflicts.

In mid-2020, Sternship Advisers merged with Ashanti Capital establishing the Group’s Equity Capital Markets division. Sternship’s ECM division provides expertise on equity capital markets and helps facilitate institutional client transactions, including raising capital for pre-IPOs, IPOs, RTOs, convertibles and second market offerings for listed and unlisted companies.

The ECM team has a strong track record of bringing value-add strategics to client registers complimented by an ultra high net worth distribution network and deep relationships with leading institutions across the Asia Pac region.

Sternship provides leading, independent M&A advice across a wide range of transaction types including:

- Domestic and cross border mergers & acquisitions;

- Takeover defence;

- Strategic investments;

- Trade Sales and demergers;

- Joint venture and farm-in agreements; and

- Management buy-outs and private equity transactions

Sternship’s strong M&A capability is demonstrated through our extensive transaction experience & team profile

Sternship clients benefit from direct senior relationships with both domestic and global corporates and with leading institutional investors which shape and influence both the Australian and International equity markets.

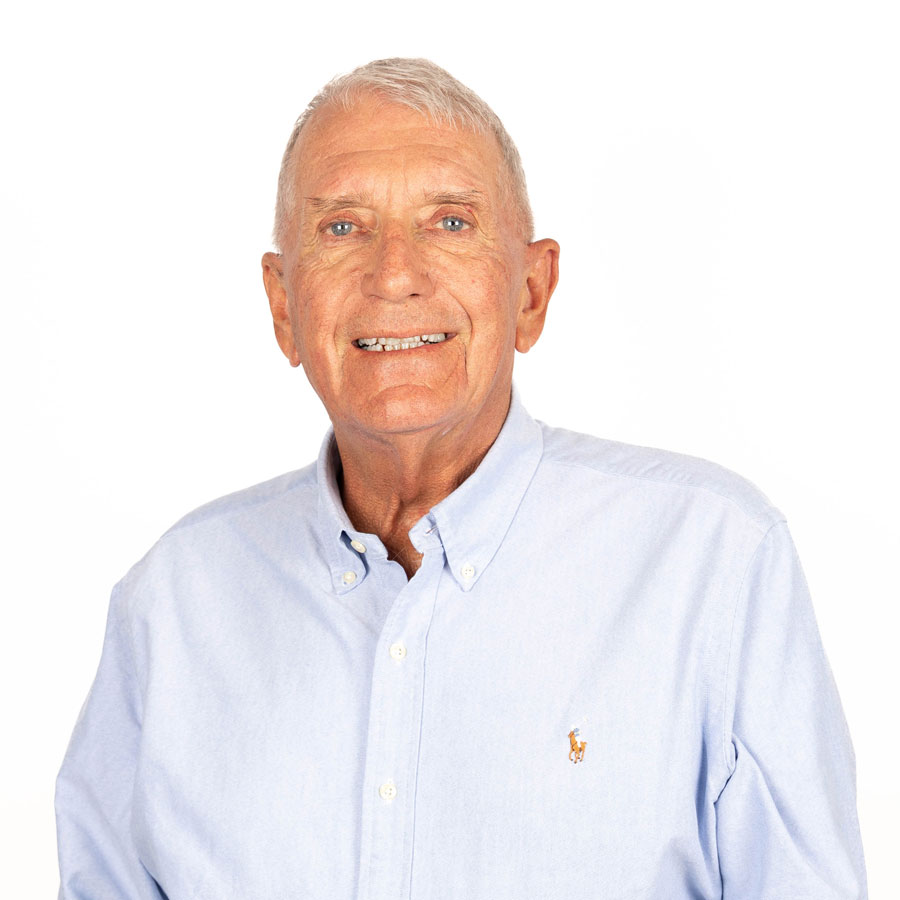

Team

Experience

Acquisition of

4D Delta Pty Ltd

A$395m

Funding Package

A$44.5m

Acquisition of Global Uranium and Enrichment

A$490m

Initial Public Offering

A$250.0m

Acquisition of Laverton Gold Project from Focus Minerals

A$16.6m

Strategic Capital Raising to Omega Oil & Gas

A$30m

Placement

A$31.7m

Placement

A$395m

Funding Package

A$215m

Placement

A$490m

Initial Public Offering

US$10m

Loan Facility

High yield bond restructure

US$20.0 million

Project Finance

Convertible loan to Lanco*

Debt refinance*

A$350.0 million

Debt Bridge and Follow-on Bond

* Indicates team members’ transactions prior to Sternship